Real Estate Reno Nv - The Facts

Table of ContentsFascination About Real Estate Reno Nv5 Simple Techniques For Real Estate Reno Nv7 Simple Techniques For Real Estate Reno Nv7 Easy Facts About Real Estate Reno Nv ExplainedReal Estate Reno Nv for BeginnersThe Best Guide To Real Estate Reno Nv

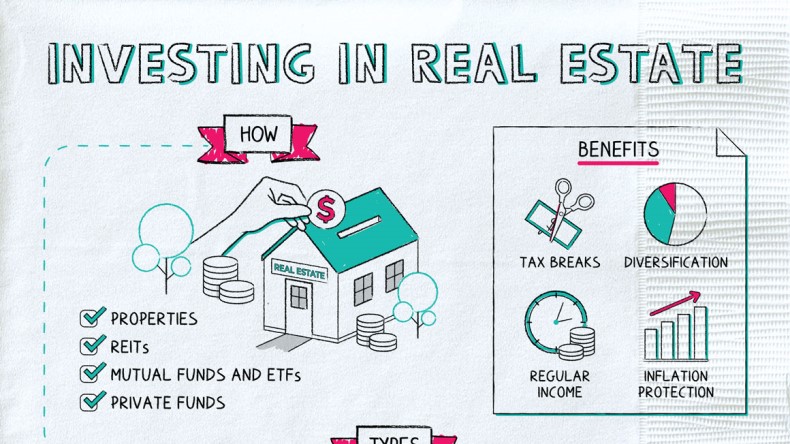

The advantages of buying real estate are countless (Real Estate Reno NV). With well-chosen possessions, investors can enjoy predictable capital, exceptional returns, tax obligation benefits, and diversificationand it's feasible to take advantage of realty to construct wide range. Considering buying property? Here's what you require to recognize concerning genuine estate advantages and why real estate is taken into consideration a great investment.

The advantages of purchasing genuine estate include passive revenue, secure capital, tax obligation benefits, diversity, and utilize. Genuine estate investment trusts (REITs) provide a method to invest in real estate without having to possess, operate, or money properties. Capital is the earnings from a realty investment after home loan settlements and operating expenditures have been made.

Real estate worths tend to increase gradually, and with an excellent investment, you can turn a revenue when it's time to market. Leas also have a tendency to rise gradually, which can cause higher capital. This graph from the Reserve bank of St. Louis reveals mean home costs in the U.S

The 3-Minute Rule for Real Estate Reno Nv

The locations shaded in grey show U.S. recessions. Median List Prices of Residences Sold for the United States. As you pay for a residential or commercial property home loan, you build equityan property that becomes part of your net worth (Real Estate Reno NV). And as you construct equity, you have the leverage to purchase more residential properties and enhance capital and wide range a lot more.

Property has a lowand sometimes negativecorrelation with various other significant asset courses. This indicates the enhancement of real estate to a profile of diversified properties can reduce profile volatility and supply a greater return per device of threat. Leverage is making use of numerous monetary tools or obtained funding (e.

The smart Trick of Real Estate Reno Nv That Nobody is Talking About

As economic situations increase, the demand genuine estate drives rents greater. This, subsequently, translates right into greater funding worths. Consequently, realty tends to maintain the purchasing power of capital by passing some of the inflationary stress on renters and by integrating some of the inflationary pressure in the kind of resources recognition.

There are numerous ways that possessing real estate can shield against inflation. Second, rents on investment homes can increase to keep up with rising cost of living.

One can profit from marketing like it their home at a cost greater than they paid for it. And, if this does occur, you might be responsible to pay taxes on those gains. Despite all the advantages of buying genuine estate, there are drawbacks. Among the primary ones is the lack of liquidity (or the loved one difficulty in transforming an asset right into cash and cash into an asset).

Get This Report about Real Estate Reno Nv

Yet amongst the simplest and most usual methods is simply purchasing a home to rent out to others. So why invest in real estate? Besides, it calls for far more job than merely clicking a few switches to spend in a common fund or supply. The fact is, there are several property benefits that make it such a preferred option for knowledgeable capitalists.

The remainder goes to paying down the finance and structure equity. Equity is the worth you have in a home. It's the difference between what you owe and what the dwelling or land is worth. In time, routine payments will ultimately leave you having a residential property complimentary and clear.

Some Known Facts About Real Estate Reno Nv.

Any individual that's gone shopping or filled their container recently recognizes exactly how inflation can ruin the power of hard-earned cash. One of one of the most underrated actual estate benefits is that, unlike several traditional financial investments, realty worth tends to go up, also during times of notable rising cost of living. Like other essential assets, property frequently keeps value and can therefore function as an outstanding area to spend while greater prices gnaw the Learn More Here gains of read this article different other investments you might have.

Appreciation describes money made when the total value of a possession rises in between the moment you buy it and the time you sell it. For actual estate, this can suggest significant gains because of the typically high rates of the assets. Nevertheless, it's critical to remember admiration is an one-time thing and only offers money when you market, not along the way.

As stated earlier, capital is the money that comes on a monthly or yearly basis as a result of possessing the residential or commercial property. Generally, this is what's left over after paying all the necessary expenditures like mortgage settlements, repairs, tax obligations, and insurance. Some residential or commercial properties may have a considerable capital, while others may have little or none.

The Main Principles Of Real Estate Reno Nv

New investors may not genuinely recognize the power of take advantage of, yet those who do open the potential for big gains on their financial investments. Typically speaking, leverage in investing comes when you can have or regulate a bigger amount of possessions than you could or else spend for, with the use of credit history.